Which multi-currency account to choose? Our explanations

Imagine a world with a single bank account for all your needs, even in currencies other than the euro.

This is the promise of multi-currency accounts .

For expatriates or frequent travellers, it is neither more nor less than the realization of an old dream…

But is it really reliable? How it works ? How much does it cost ? What are the limitations?

As with any major innovation, the multi-currency account brings its share of questions.

However, judging by the enormous successes of neobanks like Revolut , Wise (ex Transferwise ) or Vivid , it would seem that patience has finally paid off… both literally and figuratively!

Discover with us the multi-currency account from all angles.

SUMMARY

How it works ?

Handle the multi-currency account like a pro

Comparison of multi-currency accounts

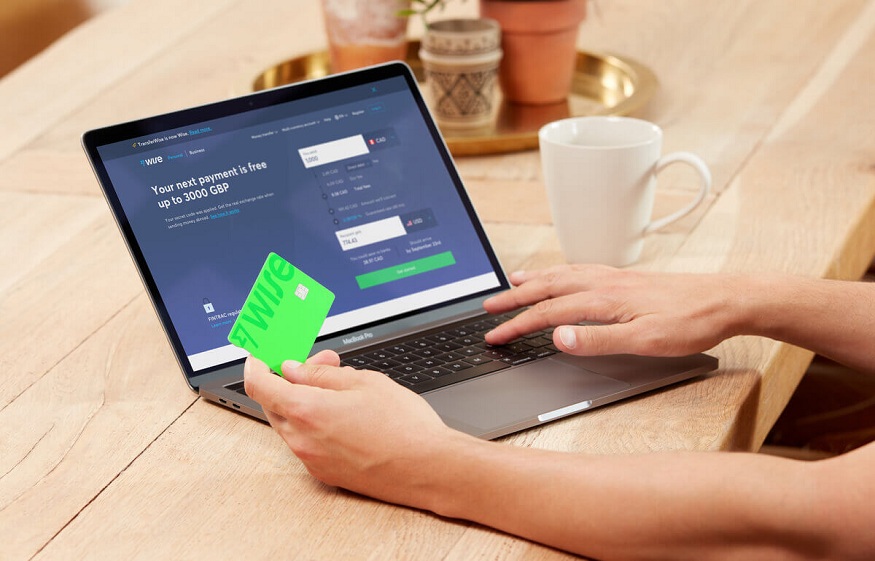

BEST MULTI-CURRENCY ACCOUNT: WISE

done Ultra-competitive fees, with real exchange rate

done Wider choice of currencies with local coordinates (USA, Canada, United Kingdom, etc.)

done Most enjoyable user experience, including free virtual cards

done Wise (formerly Transferwise) is a European Fintech heavyweigh

WHAT EXACTLY IS A MULTI-CURRENCY ACCOUNT?

Multi-currency accounts are an innovation to be credited to neo banks .

Here are the 4 main ones with this feature:

Since its launch in 2015, Revolut has won the hearts of travelers by popularizing the multi-currency account.

Specializing in its beginnings in low-cost international transfers, Wise has mutated into a neobank with the introduction of a particularly successful multi-currency account

Of German origin, Vivid stands out with a free metal bank card and more than 100 currencies available in its sub-account

Less known, the latter mainly acts as a bridge between the euro zone and the United Kingdom, thanks to a double account in EUR or GBP.

Other initiatives have emerged, such as Ditto or Ferratum Bank , but the success has not been there.

From a “classic” bank account, a multi-currency account allows you to open “sub-accounts” in the currency of your choice.

For example, here with Wise , it only takes a few clicks to open an account in US dollars, Swiss francs or rubles.

You just have to choose from the proposed list, knowing that in some cases, the currency sub-account may have its own local bank details :

Admit that it is still more practical than moving around the country!

Then, currency management is done very intuitively between the balance differences of each sub-account.

In the example below, we have three sub-accounts in euros, US dollars and Chilean pesos: