How to Choose the Best Nifty 50 Index Fund: Key Factors to Consider

Index funds represent a widely favored investment option for passive investors who want to grow their wealth effectively. The Nifty 50 Index Fund ranks among the top selections for investors who wish to commit to long-term investments from the wide range of available index funds. Choosing the best Nifty 50 Index Fund from numerous market options remains challenging for investors. This guide shows you which essential factors to evaluate before you make a well-informed decision.

Understanding the Nifty 50 Index Fund

The Nifty 50 Index Fund functions as a mutual fund designed to replicate the performance of the Nifty 50 Index. The index contains India’s 50 biggest companies with high liquidity that trade on the National Stock Exchange (NSE). Investors gain exposure to the broader Indian economy through the fund’s well-diversified stock selection across various sectors while reducing individual stock investment risks.

Whereas actively managed funds require fund managers to select stocks Nifty 50 Index Funds only track the index to deliver a passive investment approach with reduced costs.

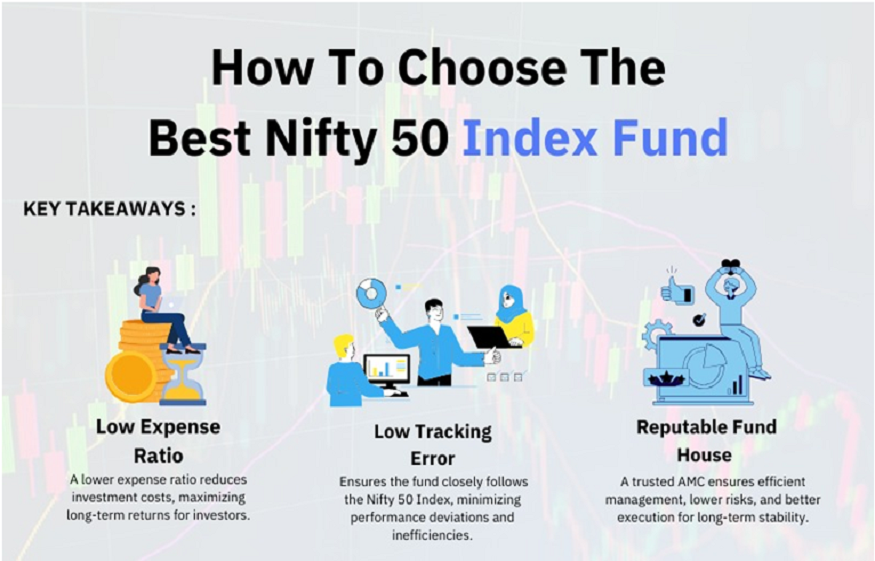

Important Considerations When Selecting a Nifty 50 Index Fund

1. Expense Ratio

The expense ratio is a measurement of the yearly management fees that the fund house charges you for taking care of your investment. Nifty 50 Index Funds employ a passive investment strategy which results in lower expense ratios than those of actively managed funds. A minor variation in expense ratios produces substantial effects on long-term investment returns. Select the Nifty 50 fund with the lowest expense ratio after comparing cost structures across different funds to achieve better returns.

2. Tracking Error

A Nifty 50 Index Fund’s tracking error reveals how precisely it mirrors the performance of the Nifty 50 Index. Lower tracking error indicates superior performance replication of the index by the fund. The presence of high tracking errors points to management inefficiencies in the fund that typically result in performance lagging behind the index. Investors should examine a fund’s historical tracking error prior to making an investment decision.

3. Fund Size (Assets Under Management – AUM)

When a fund has more assets under management it reflects strong investor trust and proficient fund management techniques. The size of AUM when too large may cause problems with liquidity and rebalancing operations. Selecting a Nifty 50 Index Fund requires identifying funds with adequate but sensible AUM levels to ensure both stability and operational efficiency.

4. Past Performance and Returns

Index funds seek to mirror an index but past performance offers valuable information about the degree to which a particular Nifty 50 Index Fund has matched the Nifty 50 Index throughout its history. Although historical performance does not predict future returns, examining past data assists investors in evaluating how well the fund tracked the benchmark index.

5. Reputation of the Fund House

Asset management company (AMC) credibility and reputation significantly impact fund selection decisions. Well-regarded fund houses that have demonstrated success over time show superior fund management processes alongside reduced tracking errors and better execution efficiency. Choose a Nifty 50 Index Fund that is offered by a reputable and established AMC.

6. Liquidity and Exit Load

The liquidity of a fund measures your ability to purchase or sell its units without causing major price changes. The best Nifty 50 Index Fund options feature high liquidity levels. Investors should review exit load charges as they are fees applied when an investment is redeemed before its set timeframe. Index funds usually either lack exit loads or impose very small ones yet investors should always verify this information before committing their money.

7. Direct Plan vs. Regular Plan

Investors in mutual funds can choose between Direct Plans and Regular Plans. Investing in a Nifty 50 Index Fund Direct Plan saves money because it involves purchasing the fund straight from the fund house which eliminates distributor fees. Regular Plans require intermediaries which results in higher expense ratios. The Direct Plan can help you achieve higher returns in the long term if you feel confident managing investments by yourself.

8. Tax Efficiency

Capital gains tax applies to Nifty 50 Index Fund investments. Investments held for more than one year with gains surpassing ₹1 lakh will be subject to a 10% Long-Term Capital Gains Tax (LTCG). Investments with gains that lasted under one year face a 15% tax rate. A focus on tax-efficient strategies allows investors to refine their planning to maximize returns after taxes.

9. Dividend vs. Growth Option

Two main investment options exist for Nifty 50 Index Funds: Dividend Option and Growth Option. The Dividend Option provides consistent payouts while the Growth Option uses earnings to multiply wealth over time. The Growth Option stands as the preferable choice for those aiming to build wealth over an extended period.

10. Investment Mode: SIP vs. Lump Sum

An investment in a Nifty 50 Index Fund can be made by using a Systematic Investment Plan (SIP) or opting for a lump sum investment. Systematic Investment Plans (SIPs) enable cost averaging throughout the investment period while minimizing market timing risks which makes them ideal for investors with long-term investment horizons. When market valuations are appealing, making lump sum investments can deliver financial benefits.

What are the benefits of putting money into a Nifty 50 Index Fund?

1- The Nifty 50 Index Fund allows investors to spread their money across 50 leading companies from multiple sectors which minimizes the risks of holding individual stocks.

2- Passive management in these funds results in reduced expense ratios compared to funds that use active management.

3- The Nifty 50 Index has provided steady long-term returns which makes it a desirable choice for creating wealth.

4- Investing in a Nifty 50 Index Fund requires no active stock selection or monitoring because it is a simple investment approach.

5- These funds serve as an excellent option for long-term investors who prefer steady growth with minimal trading activities.

Conclusion

Selecting the top Nifty 50 Index Fund demands a thorough evaluation of expense ratio, tracking error, fund size, and the fund house’s reputation.