Home Credit Apps Explained: Features, Benefits, and How They Work

In recent years, home credit apps have revolutionised the way individuals access financial services. As smartphones become ubiquitous, these apps have emerged as a convenient solution for managing personal credit. But what exactly are home credit apps, and how do they fit into the rapidly evolving digital finance landscape?

Understanding Home Credit Apps

Home credit apps are mobile applications designed to offer users easy access to credit services. Primarily, they cater to individuals who may not have access to traditional banking facilities. By leveraging digital technology, these apps make the process of obtaining credit faster and more efficient. This democratisation of financial services is particularly important in countries like India, where a significant portion of the population remains underserved by conventional banking systems.

Features of Home Credit Apps

User-Friendly Interface

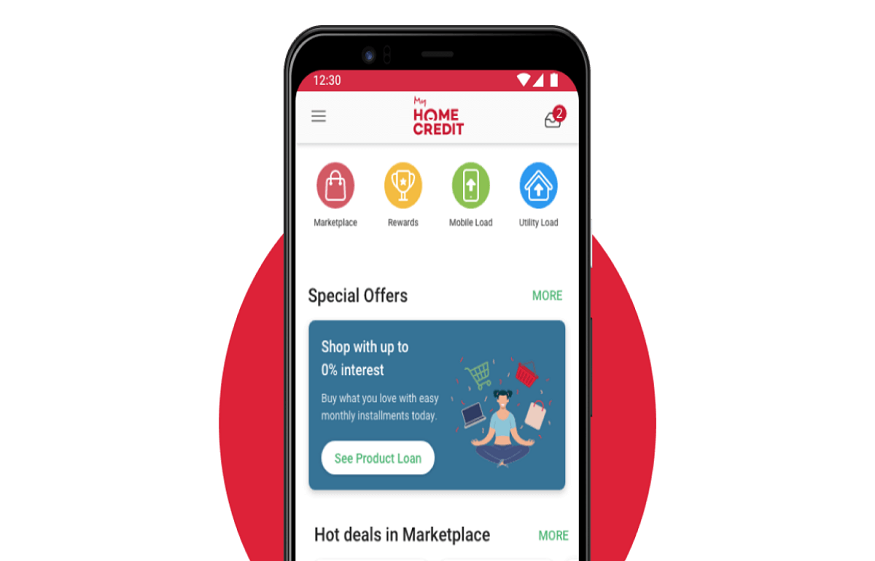

One of the most appealing aspects of home credit apps is their user-friendly interface. They are typically designed with the layperson in mind, ensuring that even those unfamiliar with financial jargon can navigate them with ease. Features like simple navigation, intuitive design, and step-by-step guidance make these apps accessible to all.

Quick Credit Assessment

Home credit apps employ sophisticated algorithms to quickly assess a user’s creditworthiness. By analysing data such as income, spending behaviour, and even social metrics, they determine the loan amount a user is eligible for. This reduces the waiting time traditionally associated with manual credit assessments.

Document-Free Applications

These apps often require minimal documentation, making the credit application process less cumbersome. In many cases, users can secure loans by simply linking their digital identities, such as Aadhaar numbers, thereby eliminating the need for physical paperwork.

Flexible Repayment Options

Flexibility in repayment is another key feature. Home credit app often allow users to select repayment schedules that suit their financial circumstances. This tailored approach helps individuals maintain financial health without defaulting on their obligations.

Benefits of Home Credit Apps

Accessibility and Convenience

The most obvious benefit of home credit apps is their accessibility. Users can apply for credit anytime and anywhere, as long as they have internet connectivity. This is a game-changer for individuals residing in remote areas where traditional banks might not be present.

Speed and Efficiency

The speed at which home credit apps process applications is remarkable. Unlike traditional methods that might take days or even weeks, these apps often approve loans within minutes. This immediacy is particularly beneficial in emergency situations where funds are required urgently.

Financial Inclusion

Home credit apps play a significant role in promoting financial inclusion. By offering credit to those without a formal banking history, they bring more individuals into the financial fold. This empowerment enables people to invest in education, health, and entrepreneurship, driving economic growth.

Cost-Effectiveness

The digital nature of home credit app means reduced overhead costs. Without the need for physical branches and extensive staff, these savings can be passed on to users in the form of lower interest rates and fees, making loans more affordable.

How Home Credit Apps Work

Application Process

The process begins with downloading the app and registering an account. Users typically need to provide basic personal information and consent to data sharing. This data is crucial for assessing creditworthiness.

Credit Assessment

Once registered, the app uses its algorithms to evaluate the user’s financial standing. This includes analysing factors such as income patterns, expenditure, existing debts, and even social signals. Some advanced apps integrate with credit bureaus for a more comprehensive assessment.

Loan Approval and Disbursement

Upon successful assessment, the app offers loan options tailored to the user’s profile. After the user selects the desired option, the funds are disbursed directly to their bank account or digital wallet, often within minutes.

Repayment and Monitoring

The repayment schedule is set based on the user’s preferences. The app sends reminders to ensure timely repayments and might offer incentives for early or punctual payments. Users can monitor their loan status, manage repayments, and check credit scores all within the app.

Challenges and Considerations

While home credit apps offer numerous benefits, they are not without challenges. Data privacy is a significant concern, as these apps collect a substantial amount of personal information. Ensuring robust cybersecurity measures is vital to protect user data from breaches.

Moreover, users must be cautious of potential pitfalls like hidden fees and exorbitant interest rates. It’s essential to read terms and conditions carefully before accepting any loan offer.

The Future of Home Credit Apps

The future of home credit apps looks promising, particularly with advancements in artificial intelligence and machine learning. These technologies can enhance credit assessments, offering even more personalised financial solutions. Additionally, integration with emerging fintech services, like digital currencies and blockchain, might further streamline operations, offering users unprecedented levels of control over their financial lives.

In conclusion, home credit apps are transforming the credit landscape by offering accessibility, speed, and efficiency. They are empowering individuals, fostering financial inclusion, and contributing to economic growth. As technology continues to evolve, these apps are likely to become even more integral to personal finance management. If you haven’t explored the world of home credit apps yet, now may be the perfect time to reconsider how you access and manage credit.