Can I open an ICICI Three in One Account online?

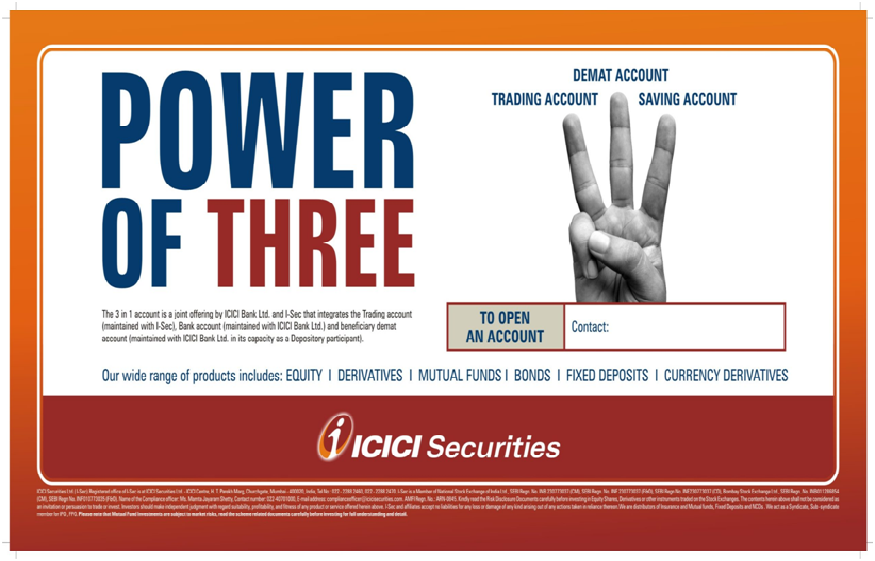

Yes, you can open an ICICI Three-in-One Account online. The ICICI Three-in-One Account combines a bank account, a trading account, and a demat account, allowing seamless transactions between these three accounts. This integrated facility is ideal for individuals interested in trading and investing in stocks, mutual funds, and other securities, as it simplifies the transfer of funds and management of investments.

To open an ICICI Three-in-One Account online, visit the official ICICI Bank or ICICI Direct website. The online process is designed to be user-friendly and convenient. You will need to fill out the application form by providing essential details such as your name, contact information, and PAN number. Additionally, you will need to complete the Know Your Customer (KYC) process. This can be done through ICICI’s e-KYC facility, which uses Aadhaar-based authentication for paperless verification.

During the application process, you may also need to upload scanned copies of necessary documents, including proof of identity (like Aadhaar card, PAN card), proof of address, and income proof if you plan to trade in derivatives. ICICI Bank also offers video KYC, where your identity can be verified through a video call.

Once your application and KYC verification are complete, you will receive account details and login credentials for your trading and demat accounts. The entire process typically takes a few days, depending on the verification timeline.

Opening an ICICI 3 1 Account online offers various benefits, including real-time fund transfers between accounts, access to research and trading tools, and the convenience of managing all financial transactions through a single platform.

Mastering Margin Trading: Your Essential Guide

Margin trading is a powerful investment strategy that allows traders to amplify their buying power by borrowing funds from a broker. While it offers the potential for higher returns, it also comes with increased risks. Mastering margin trading requires a solid understanding of its mechanics, strategies, and risk management techniques.

At its core, margin trading enables investors to open larger positions than their available capital would typically allow. For example, with a 50% margin requirement, a trader can control $10,000 worth of assets with just $5,000 of their own money. The remaining $5,000 is borrowed from the broker, who charges interest on the loan. This leverage can magnify profits if the market moves in the trader’s favor. However, losses can also be magnified, potentially exceeding the initial investment.

To succeed in margin trading, risk management is crucial. Setting stop-loss orders, maintaining sufficient margin levels, and using conservative leverage ratios help protect against substantial losses. Traders should also understand margin calls—demands from brokers to deposit additional funds if the account’s equity falls below required levels. Failure to meet a margin call can result in the forced liquidation of assets.

Another key to mastering margin trading is staying informed. Market volatility, interest rates, and geopolitical events can significantly impact leveraged positions. Continuous market analysis and disciplined trading strategies are essential for minimizing risks and maximizing returns.

In conclusion, MTF trading can be a rewarding approach for experienced investors who understand the risks and implement proper safeguards. By gaining in-depth knowledge, practicing prudent risk management, and staying updated on market trends, traders can harness the power of margin trading to enhance their investment potential.